can i get a mortgage if i owe back taxes canada

Notably the interest on a mortgage for a principal private residence is not tax-deductible. So can you get a mortgage if you owe back taxes to the IRS.

What Are Variable Fixed Open And Closed Mortgages Mortgage Mortgage Payoff Refinance Mortgage

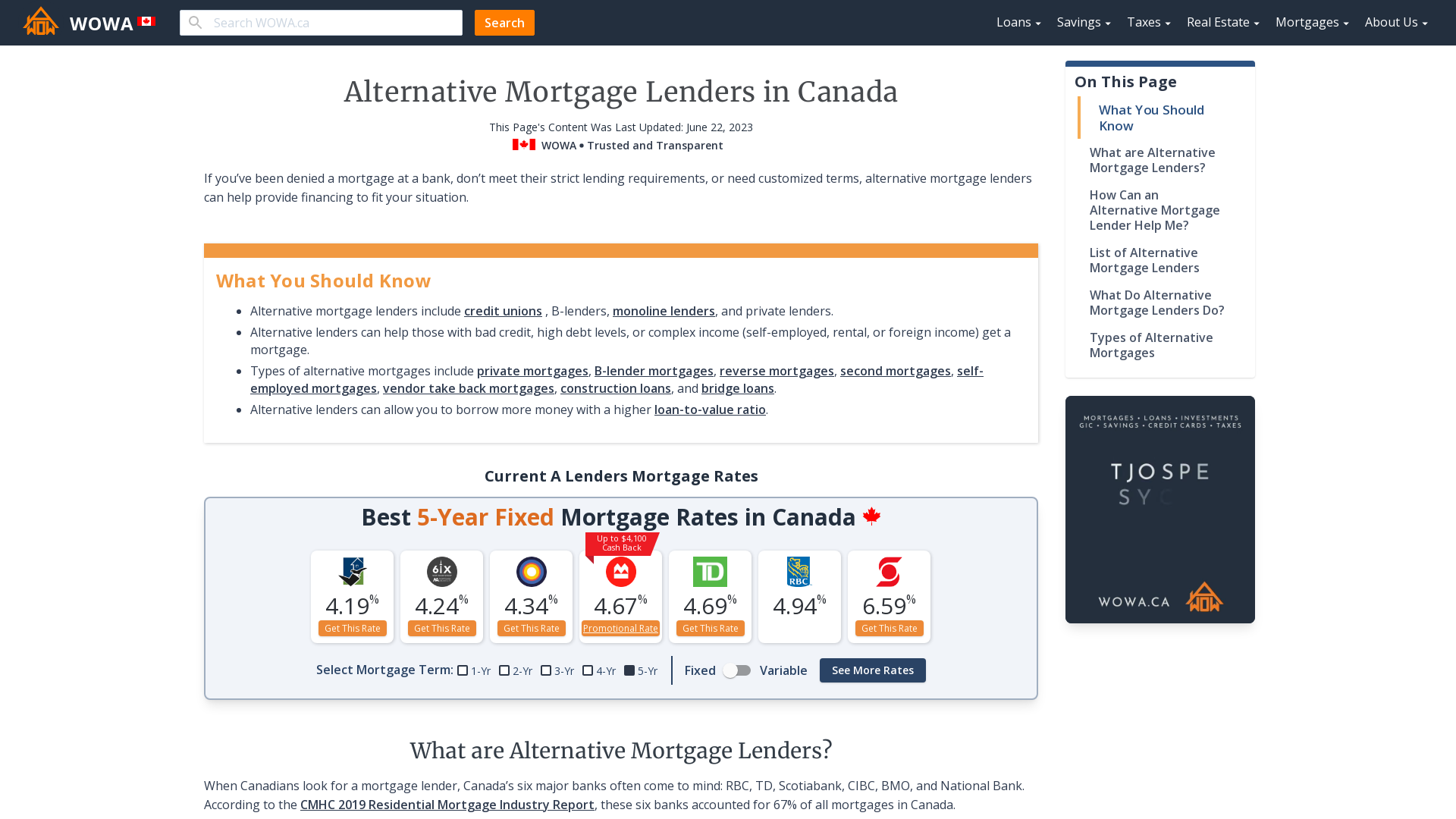

There are certain conditions that youll need to meet in order to get approved however so lets.

. Our 4 step plan will help you get a home loan to buy or refinance a property. The penalty for filing a tax return. Not paying your taxes is a crime and has major financial and personal costs.

The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan. One of the reasons why the IRS is so effective in collecting federal tax debts is because of its ability to seize and take property. Ad This Mortgage Relief Program Is Helping Homeowners Save Thousands Of Dollars.

Loans up to 3million. A tax debt doesnt equal a blanket rejection for a mortgage. Ad No tax return required.

Qualify using 12-24 months business or personal bank statements. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. Get a Great Home Mortgage Rate Online.

A smaller monthly payment will impact your debt-to-income DTI ratio the least. If youre not ready to give up on the house of your dreams call SH. The answer to this question depends on more than one factor the most important being whether or not the borrower is delinquent on the taxes owed.

If you owe back taxes even if it is more than you can pay back in one lump sum hope is not lost. Yes you might be able to get a home loan even if you owe taxes. Let the bank or mortgage company know up front that you.

You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an. Learn the Upside Disadvantages. Qualify using 12-24 months business or personal bank statements.

The good news is that you still. Also important for a self-employed borrower is. The IRS can seize your home business.

In short yes you can. After some years of confusion HUD officially announced that effective January 19th 2021 individuals classified. You can qualify for a home mortgage with outstanding unpaid taxes to the Internal Revenue Service.

If you are convicted of tax evasion it can also lead to court-imposed fines jail time and a criminal record. Ad Choose the Best Mortgage Option Right For You. Can I get a mortgage if I owe federal tax debt to the IRS.

Over 937000 Americans have. The tax law for Canadas homeowners is very different from the system in the US. The deadline for filing personal income tax returns in Canada is April 30.

Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it. For example if your home is worth 250000 and you owe 150000 on your. We have decades of.

In all likelihood you will have to pay off any back taxes you owe as a condition for getting approved for refinancing. Depending on the type of mortgage they are applying for FHA or. In general borrowers who.

In a Nutshell. Our Reverse Mortgage Calculator May Assist You In Better Understanding Eligibility Try It. Loans up to 3million.

Mortgage lenders are focusing on if you owe CRA money and will require you to prove your taxes have been paid before lending. Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a. However HUD the parent of FHA allows borrowers with outstanding federal.

It is possible to be approved for a VA loan or an FHA loan if you owe back taxes. HomeEquity Bank offers the Canadian Home Income Plan CHIP which is available across Canada. Qualify using 12-24 months business or personal bank statements.

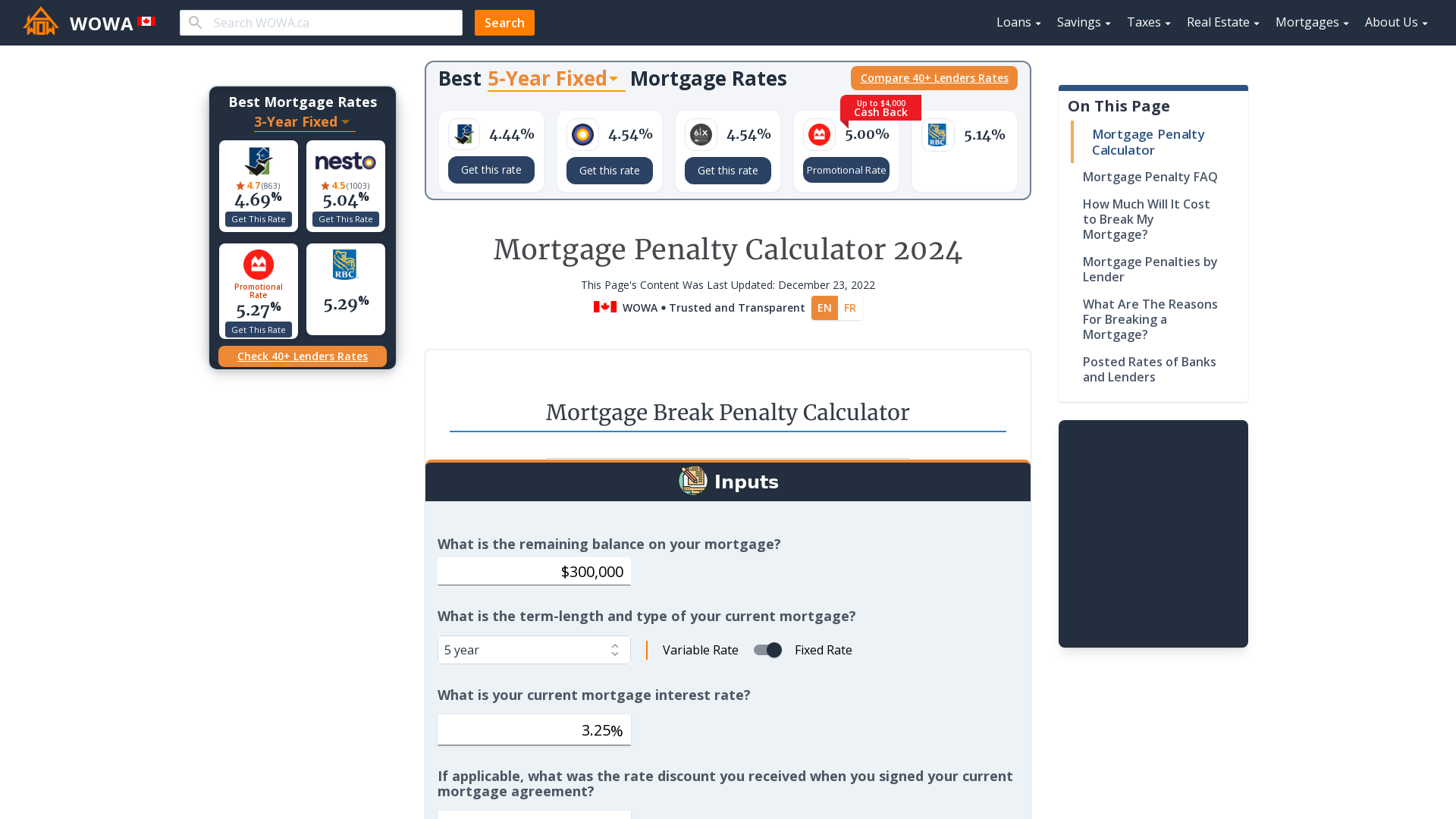

When tax liens are involved it can make the process a stressful one. Qualify using 12-24 months business or personal bank statements. If you are on a payment plan with the IRS youll have to provide your lender with documentation about your plan and incorporate those payments into your debt-to-income.

Ad Protect your mortgage with life insurance for homeowners. Two financial institutions offer reverse mortgages in Canada. If you have self-employment income you have until June 15 to file your taxes.

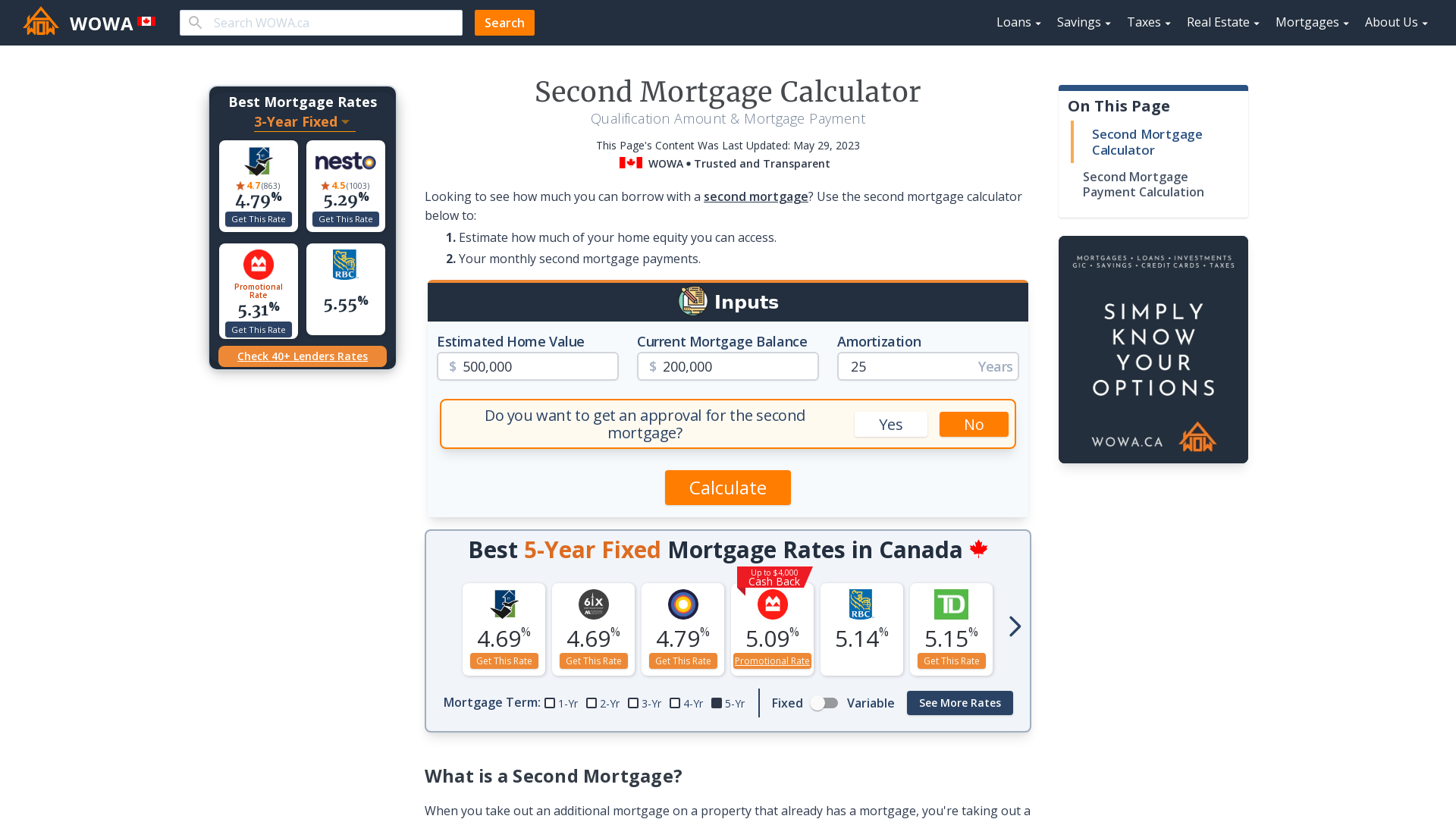

Home equity is the difference between the value of your home and how much you owe on your mortgage. You can get a reverse. If your DTI is 44 without the IRS monthly payment determine how can pay and still keep your.

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. New Mortgage Relief Program Gives Back 3708 To Homeowners In Relief. Ad Are You 62 and Have Good Credit.

See How Much You Can Save in Just a Few Minutes. Your borrower does NOT need to pay off the entire tax debt that they owe in order to qualify for a mortgage. Protect your investment with life insurance for homeowners.

Answer 1 of 8. Ad No tax return required.

![]()

Cosigning On A Mortgage Things You Need To Know Loans Canada

Mortgage Penalty Calculator 2022 Wowa Ca

Will I Be Able To Buy A House If I Owe Taxes Loans Canada

Mortgage Document Checklist What You Need Before Applying For A Mortgage

![]()

Will I Be Able To Buy A House If I Owe Taxes Loans Canada

5 Tax Tips For Canadian Families Callistas Ramblings Small Business Tax Deductions Mortgage Payoff Business Tax Deductions

How To Get Pre Approved For A Mortgage In Canada Approval Process Nesto Ca

Will I Be Able To Buy A House If I Owe Taxes Loans Canada

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

![]()

What Happens If You Miss A Mortgage Payment Loans Canada

Tax Changes For 2020 Filing You Must Know Canadian Budget Binder Income Tax Return Filing Taxes Income Tax

Second Mortgage Calculator Qualification Payment Wowa Ca

How To Make Your Canadian Mortgage Interest Tax Deductible

Mortgage Documents Checklist Loans Canada

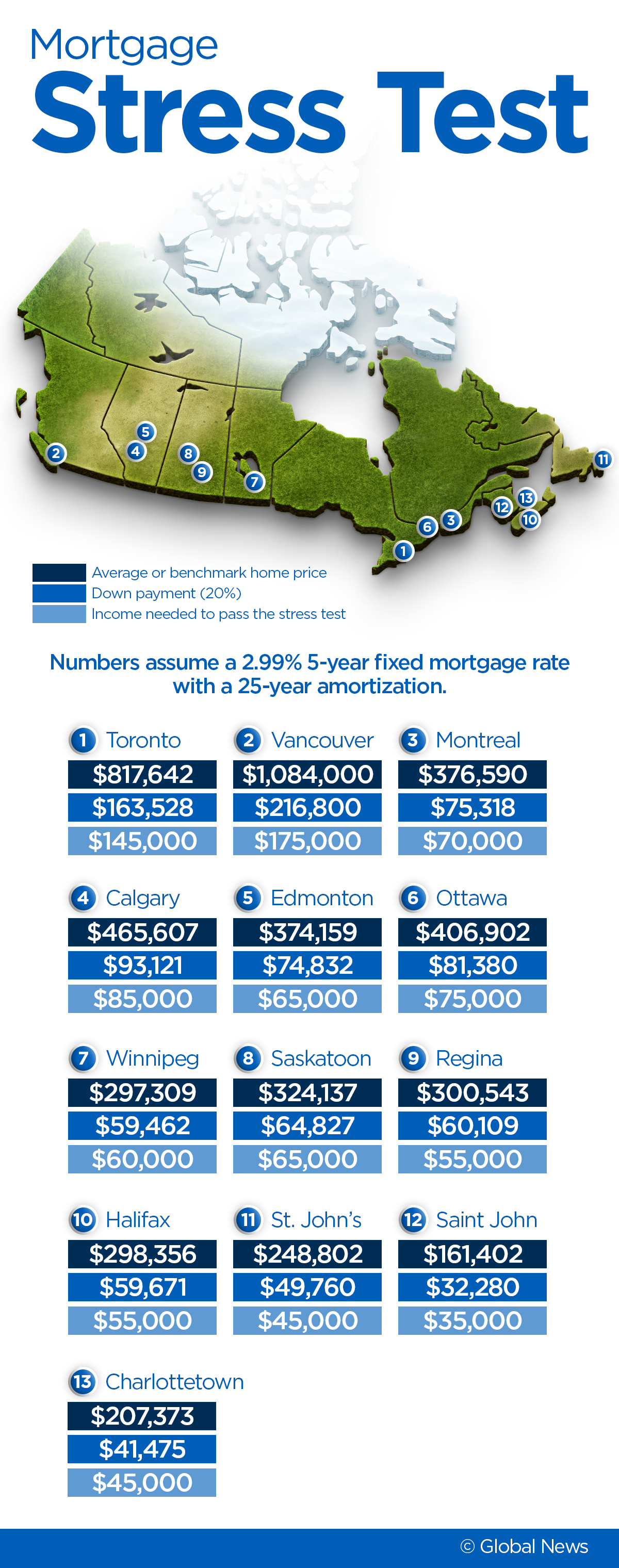

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

How To Make Your Canadian Mortgage Interest Tax Deductible